In Our View

Convertible Arbitrage Market Dynamics

A conversation between

Global Head of Convertible Arbitrage

Global Co-Head Client Partner Group

Michael Gubenko: Following a quiet period of new issuance in, the Convertible Bond (“CB”) market, it now seems to have regained vigor. What are the main dynamics at play?

Stephane Mantelin: Coming into the new year market participants were very optimistic about primary issuance in 2024 and beyond for a number of reasons. For one, higher interest rates correlate positively to issuance volumes. Oftentimes when an issuer contemplates issuing new debt, the choice between a convertible and a straight bond is effectively a trade-off between the cost of their respective coupons, the willingness to sell equity optionality and the possibility to incur future dilution. That choice was a no-brainer for much of the last decade, as low interest rates allowed corporates to finance themselves extremely cheaply in the fixed income market without any dilutive component. Within the current higher rate environment, the debate is much more nuanced; a typical High Yield issuer is bound to save several percentage points of annual interest expense by issuing a convertible bond, making it more palatable for corporates at a time of increased scrutiny on cash flows.

At the same time, there is a very large debt maturity schedule approaching between 2024-2026. Much of this is accounted for by debt that was originated immediately after the onset of COVID and is coming to maturity, whether that’s existing convertible, straight Investment Grade (“IG”) or straight High Yield-rated debt. We expect the CB market to capture a bigger slice of these elevated refinancing volumes.

Lastly, and this is mostly relevant in the US, the economy is doing relatively well and markets are at or near their all-time highs. This dynamic should support more activity in primary markets as corporates that find themselves on a strong foothold are willing to invest in their businesses, in capacity, in CapEx or M&A. We expect to see these factors also contribute to more issuance of convertible bonds.

Michael Gubenko: When thinking about the convertible bond market, what’s different today versus the recent past?

Stephane Mantelin: I believe that over the next few years we will see a broader spectrum of issuers. The CB market has historically been preferred by High Yield borrowers and non-profitable growth companies. You rarely saw, particularly in the US, issuers rated “A” or above tap the CB market. We still expect High Yield borrowers to be very active over the next couple of years, but because of the coupon saving differential, we’re seeing a noticeable pickup in issuance from non-traditional, higher rated, more rate-sensitive sectors like Utilities or REITs. In the US and Europe, we’ve seen a dozen or so very large transactions for A-rated Utility companies and that momentum is likely to continue as corporate advisors educate issuers on this additional financing option. That is great news for the convertible market as it’s a sign of maturity and less reliance on the high growth businesses that typically use the product. For investors, this diversity will translate into a more balanced portfolio in terms of types of businesses, industry, and credit ratings.

“We have seen this trend reverse over the past two years as the dramatic underperformance of long-only funds became obvious through recent market swings.”

Michael Gubenko: What do you consider critical for success in your investment approach?

Stephane Mantelin: The two core risk factors that make up a convertible are its credit and equity components. For IG names, which benefit from a visible credit curve based on straight debt or CDS that you can use as a benchmark, it becomes relatively straightforward to pinpoint the right assumptions to make and gives you the ability to value a convert with a high degree of precision. When dealing with smaller, higher growth companies which do not have any other debt on the balance sheet, fundamental analysis becomes critical to understanding whether an instrument’s credit spread should be 300 or 600. The credit component is a key input in how we approach trade construction and assess hedge effectiveness. This is why we spend a disproportionate amount of time underwriting the credit of a CB than we do in underwriting the equity. This is a key differentiator in our style of arbitrage investing. Sculptor has a large team dedicated to opportunistic credit that we collaborate with daily, as well as a centralized multi-asset investment platform that we can lean on for investment insights. In addition, we continue to grow the team, including dedicated credit analysis, to expand our underwriting capacity amidst the fertile opportunity set.

Managing the equity risk factor is easier, because it is relatively easy to hedge, and we benefit tremendously from having access to a best in class dedicated team of Portfolio Finance specialists. Outside of that, no analysis is complete without looking at other factors as well, such as legal (prospectus) risk, liquidity and of course, the interest rate component.

Michael Gubenko: What does the recent rally in equity and credit markets mean for CBs?

Stephane Mantelin: We spend a lot of time analyzing how equity and credit valuations feed through to the convertible pricing, as any delayed reaction creates opportunity when the convertible market doesn’t adjust for those moves. The more volatile the environment, the more often you see these dislocations and because of our flexible structure we can lean in when valuations are cheapening and harvest returns when pricing feels rich, without taking an outright view on market direction.

Michael Gubenko: Who’s buying convertible bonds?

Stephane Mantelin: For the first time since the Global Financial Crisis (GFC) hedge funds have returned as the dominant force and marginal buyer for CBs. The GFC triggered a mass exodus of hedge funds whose excessive use of leverage combined with a sudden shift in liquidity led to extremely poor performance. That void was ultimately filled by the long-only community who bought convertibles as a way of expressing directional views on equity and credit. Over the last several years, long-only influence became even more pronounced due to the growth of passive investing and ETFs. This meant trading activity became correlated to underlying investor flows, as opposed to fundamentals. This resulted in a lack of price discipline that pushed valuations to extreme levels. So much so that a large part of our activity became shorting CBs against buying the hedges because too much money was chasing too little paper.

We have seen this trend reverse over the past two years as the dramatic underperformance of long-only funds became obvious through recent market swings. As a direct consequence of that, their importance within the market dwindled dramatically, and hedge funds again became dominant in influencing valuations which has translated to more discipline in pricing primary deals.

That said, we are cognizant that a less diverse investor base can have an impact on liquidity. When there’s a broad market move downwards, or even when a single stock goes through a negative fundamental development, a more homogenous market structure can pose a headwind. This forces us to err on the side of caution when considering holding periods when entering a position. We now assume as our base case that we are going to own an instrument until maturity. This inherently raises the threshold on purchasing a CB in the first place and results in lower turnover. Part of this risk does however get priced in, which goes back to needing to exercise better price discipline.

Michael Gubenko: Why is pricing discipline so important?

Stephane Mantelin: If we see signs of deterioration to economic health, the bar to successfully refinance debt will rise meaningfully which means that effective credit underwriting could unveil a number of opportunities. This could also be a source of upside for those with the right skill set in credit and trade construction.

Michael Gubenko: Where can investors expect opportunities to invest and what areas are you cautious on?

Stephane Mantelin: It’s all contingent on the magnitude of risk. At one extreme we see a lot of implied cheapness in Asian credits given the challenges there on the back of Chinese macroeconomic concerns and geopolitical tensions. When assessing more speculative business models or any industries that might be sensitive to geopolitical issues (e.g., semiconductors), we add several additional levels of scrutiny in our underwriting. On the flipside, one can extract good risk/reward in situations with low credit volatility and a liquid stock. In other regions, you have situations like the IG-rated issuers I mentioned earlier where simpler trade constructs means margins are much thinner, but the risk is dramatically lower hence there’s a great opportunity to deploy capital in size.

Due to the stability of our capital as part of a multi-strategy fund, our financing, how we calibrate our hedges, and how we manage liquidity pockets, we have consistently done well navigating episodes of market stress by taking a longer-term view and we look forward to taking advantage of more of them in the future.

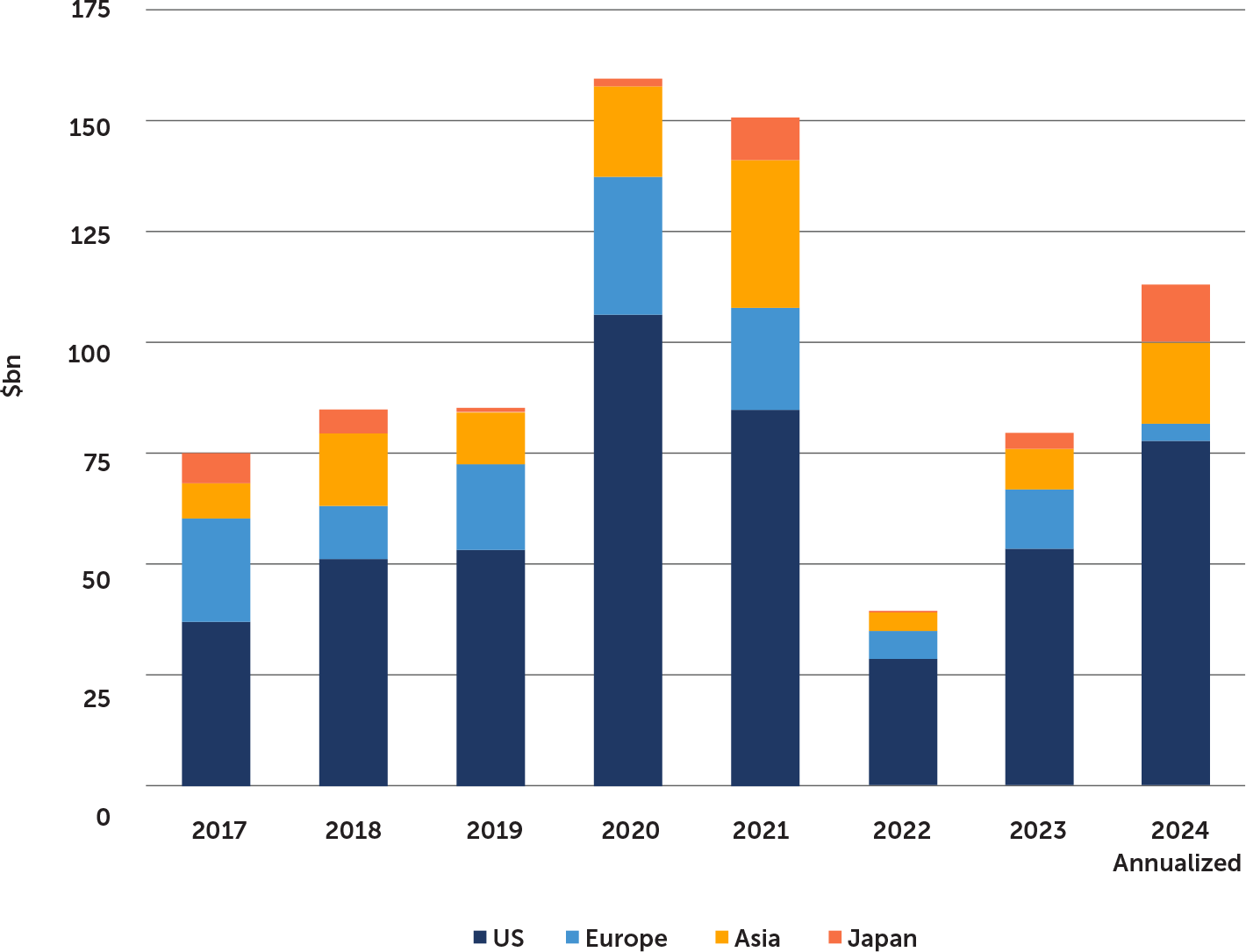

Global Convertible Bond Issuance 1

Important Information

This material is provided to you for informational purposes only. This is neither an offer to sell nor a solicitation of any offer to buy any securities in any fund or account managed by Sculptor Capital Management, Inc. or Sculptor Capital LP and its affiliates (collectively, “Sculptor Capital Management,” the “Firm,” “Sculptor,” or the “Company”), nor does it constitute a financial promotion, investment advice or an inducement or incitement to participate in any produce, offering or investment. Any offer to purchase or buy securities or other financial instruments will only be made pursuant to an offering document and a subscription document, which will be furnished to qualified investors on a confidential basis at their request for their consideration in connection with any such offering. Any investment decision should be based on the information contained in the private placement memorandum. This material does not create any advisory relationship; such a relationship may only be established through a formal advisory contract.

The statements made herein reflect the subjective views and opinions of Sculptor. Such statements cannot be independently verified and are subject to change. There can be no assurance that the investment discussed herein will ultimately be successful or are representative of all investments made in a particular Sculptor strategy or product. The information contained herein may not be reproduced or used in whole or in part for any purpose, and there can be no assurance any investment strategy will perform as discussed herein or that any historical trends will persist in the future. The source of all information contained herein is Sculptor, unless otherwise noted. Past strategy and investment allocations are not necessarily indicative of future strategy or investment allocations.

While private investment funds offer investors the potential for attractive returns and diversification, they pose greater risks than more traditional investments. Investors’ capital is at risk and investors may lose all or a substantial portion of their investment. Investors should consider the risks inherent with investing in private investment funds, which include, but are not limited to, leveraged and speculative investments, limited liquidity, higher fees and expenses and complex tax structures. The tax treatment of any investment will depend on the individual circumstances of each investor and may be subject to change in the future. Sculptor has in place policies and procedures designed to prevent market abuse and insider dealing. These policies and procedures are reviewed on a regular basis.

Certain information contained in this document constitutes “forward-looking statements” that can be identified by the use of forward-looking terminology such as “may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of any Sculptor Capital investment may differ materially from those reflected or contemplated in such forward-looking statements.

Some of the information contained herein has been obtained from third party sources. Sculptor has relied on the accuracy of such information and has not independently verified its accuracy. Sculptor makes no representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein. Certain economic and market conditions contained herein have been obtained from published sources and/or prepared by third-parties and in certain cases has not been updated through the date hereof. All information contained herein is subject to revision and the information set forth herein does not purport to be complete. Past performance is not a reliable indicator of future results. A more detailed description of Sculptor’s investment strategy, objectives and related risk will be made available upon request. Past performance of any individual investment or Sculptor fund is not indicative of their future performance.

The information contained in this document is presented to inform decisions to use Sculptor Capital LP as an investment adviser.

1. BofA Global Research, as of May 2024