What We See

The Opportunistic Lending Era Replaces the Default Cycle

New Money is the New Distressed Investing

Much of the classic distressed playbook is now obsolete to companies managing through change, including dramatic fundamental, economic, and rate shocks. Instead of “reaching” the traditional, and often abrupt, default cycle, companies are now working with credit capital providers in a rolling fashion using increasingly inventive out of court maneuvers. And almost every case involves an opportunistic lender providing the company with the new capital it needs to meet its objectives. Investors who are accustomed to a point-in-time default cycle risk waiting in vain and missing the opportunity set that has already arrived in full force.

The era of opportunistic lending is already here. Instead of buying debt instruments at steep discounts amidst spiking default rates in the hopes of converting to equity, improving the company, and selling years later in a better economic environment, investors today can serially make new loans at equity like returns while sitting at the top of the capital structure, backed by good collateral, and protected by strong documents. These loans are typically secured, stand first in line for repayment, cannot be worked around, and benefit from healthy value cushions beneath.

Nearly two decades of easy money coincided with vast technological innovations and structural shifts in credit markets to create these conditions.

Nearly two decades of easy money coincided with vast technological innovations and structural shifts in credit markets to create these conditions. Ultimately, more aggressive sponsors and lax creditor protections offered the spark, while opportunistic lenders provided the fuel and structural expertise to power this change. Rather than entering an insolvency proceeding, companies are instead extending the life of the equity option by taking on new and different forms of borrowing, often structured at the expense of existing creditors.

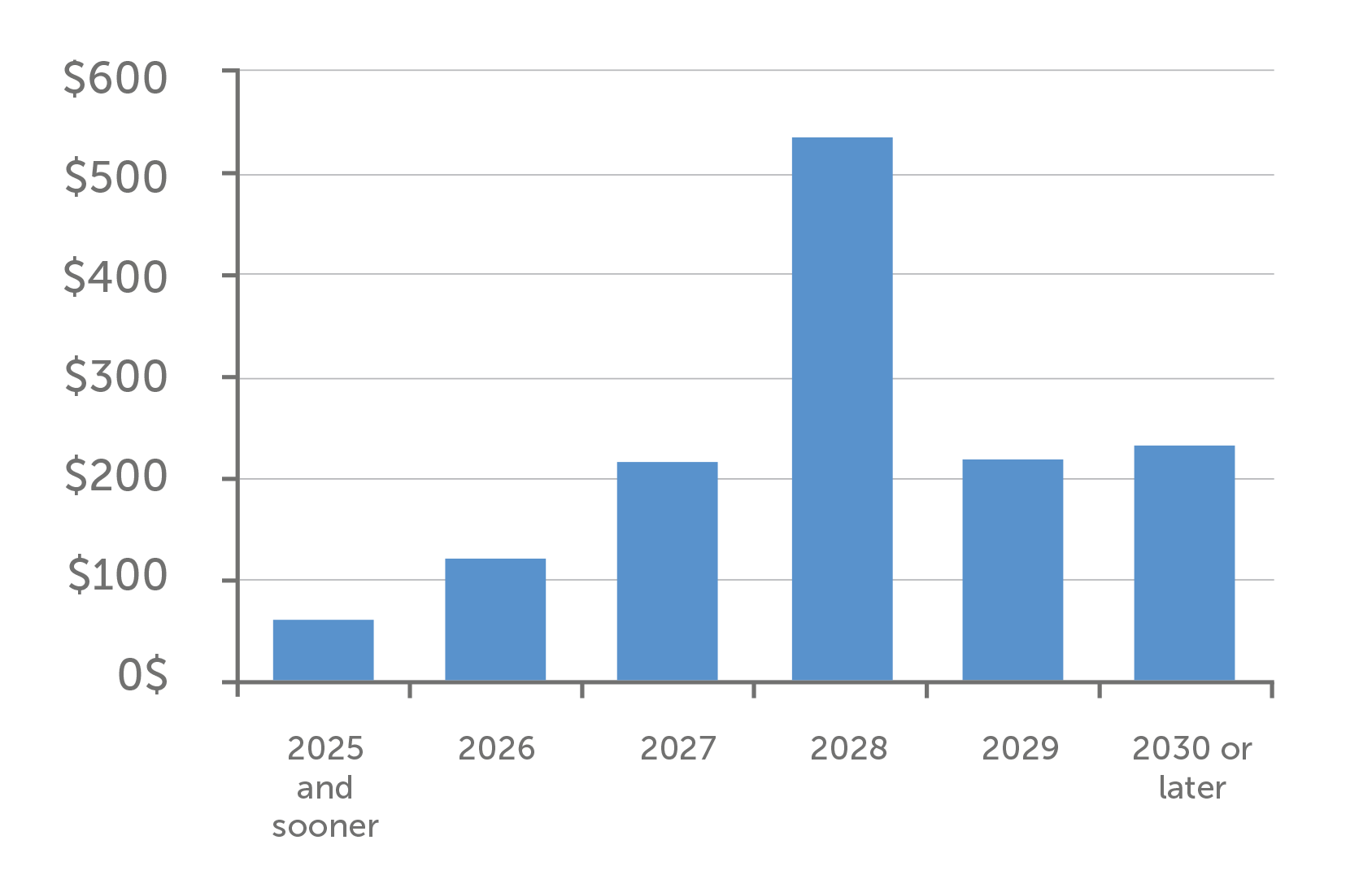

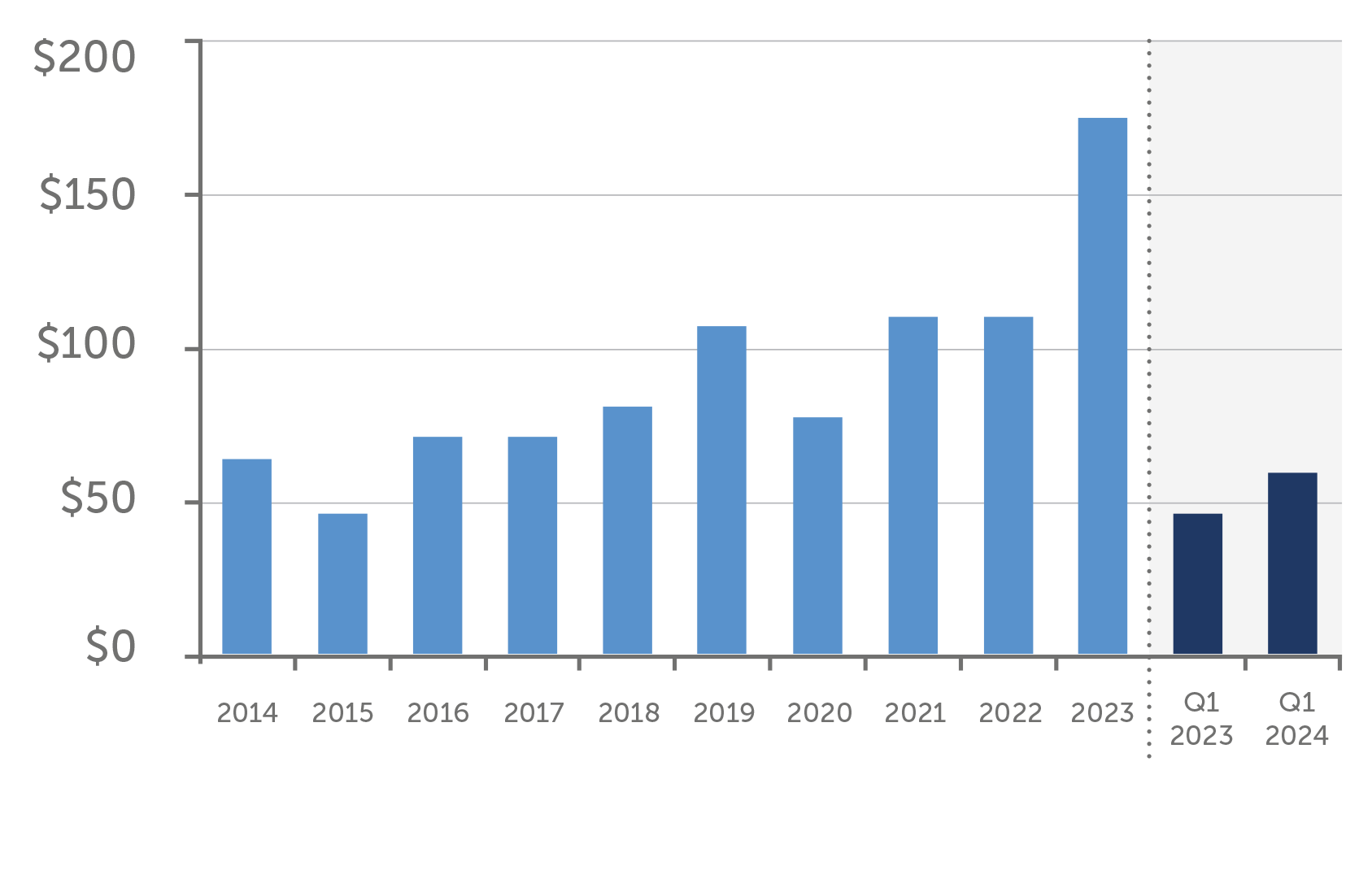

This contrasts meaningfully with the old default cycle which happened at discrete points in time, often when maturity walls coincided with market stress. Simultaneously, capital structures proved unfinanceable and fixed charges uncoverable. A negative feedback loop would begin with defaults causing lending markets to seize, precipitating still higher defaults, in turn tanking secondary market prices, and putting further stress on new lending and so on.

This is not to say that there are no consequences of today’s higher rates and inflation for stretched corporate capital structures, underwritten with aggressive cashflow assumptions and peak margins. We observe a breakdown in the sanctity of seniority for existing lenders, an extension of the option for existing equity investors, and a new investment opportunity for providers of flexible credit capital. The implementation takes many forms including unrestricted subsidiaries, dropdowns, priming, collateral stripping, or even voluntary transactions in which existing lenders are simply better off than the worst case scenario legally allowed. Sometimes those existing lenders discover the vulnerability of those loans when it is already too late. Sometimes they know it all along, but their own economic incentives can turn an ostensibly grievous confiscation of value into a welcomed repositioning. We have seen this for several years and believe it will continue until the ZIRP era maturity wall has been climbed, or more accurately, bulldozed. Opportunistic lenders with flexible capital will happily lead the way, providing basis-protected secured loans with returns that most sponsors would have underwritten in those same companies through the equity.

US Leveraged Loan

Maturity Wall ($B)

Source:LCD Pitchbook

US Leveraged Loan

Amend-and-Extend Volume ($B)

Source:LCD Pitchbook

WHAT CHANGED?

What happened to the “default cycle” or “credit cycle” that is supposed to occur when companies gorge on cheap debt, rates rise, the economy slows, and the maturity wall looms?

Lax credit documents and the evolution of “workout technology”

Said simply, “first lien” lenders generally expect to get paid back or recover principal before anyone else. Traditionally, this has largely been true due primarily to the lender’s senior priority in the recovery waterfall and a security interest in the company’s assets. Historically, violating these provisions was difficult and uncommon except in the case of a DIP financing in Chapter 11.

However, over the past several years these contractual anti-layering protections have been materially weakened. As a result, a company’s most expedient path to preserve optionality today is often on the backs of the existing lenders through out-of-court deals (i.e. no bankruptcy process). Many of the provisions that allow such layering are found in the initial credit documentation at the time of the initial debt issuance. To the extent that such priming is not permitted, most current credit documents allow flexibility to be granted via simple majority amendments to the credit agreements (versus higher thresholds required in previous generations). In short, investors in leveraged loans, who believed they held the senior-most rights on the borrower’s assets, are bumped behind the new “rescue” debt with no need for a cumbersome and lengthy bankruptcy process.

Borrower stigma is gone

Many companies facing dire liquidity issues following the onset of the pandemic resorted to aggressive, controversial, and novel liability management maneuvers to stave off bankruptcy. When adversely impacted lenders turned to the courts in protest, they were met by decisions that validated a company’s use of these maneuvers as legitimate transactions permitted by the credit agreements. The case of bedding manufacturer Serta Simmons is one of several examples of courts upholding such liability management transactions. Empowered by a supportive legal framework, these structures have become a widely accepted means of preserving equity value.

Companies are more sophisticated and understand the incentives of existing and new creditors

Companies are proactively engaging with opportunistic lenders well ahead of an upcoming maturity. In addition to preserving an equity option that otherwise may have been lost in a traditional insolvency process, this method is proving faster and cheaper for creditors as well. Companies understand this dynamic and appreciate that opportunistic lenders stand ready to lend. Existing lenders who attempt to stymie the company’s liability management strategies have fewer tools to employ in their defense. Consider the incentives of a CLO or loan manager who is evaluated on the rate of realized defaults in the portfolio: a lower eventual recovery from a priming transaction might be preferable to a realized default today.

Market structure has changed

For most of history, banks made bank loans. Long after the economy hit a bump, loans would default at maturity if they could not be repaid. At that point the troubled loan would be re-marked and sold at distressed levels. Leading up to that event, banks were typically loath to “take the loss.” There was no anticipatory mechanism to reprice and rework an unsustainable capital structure. In today’s world, the capital markets are the lender. Whether it’s the broadly syndicated loan market, the club lending market, the bond market, or even the not-so-private Private Credit market, participants can smell trouble, opportunity, or both and optimize for it.

We are excited by the abundance of these opportunities and expect this investment theme to persist for the foreseeable future. A recent transaction involving a European residential real estate company helps illustrate these dynamics in play.

European Residential Real Estate Company1

A large European listed residential real estate company, was under pressure from a mismanaged and over levered capital structure in the middle of 2022. Despite the quality and prime location of the company’s fully leased multi-family assets, the company had roughly €1 billion of debt maturities coming due in the next 12 months. This came at a time when the sudden rise in interest rates put immense strain on the European real estate market, limiting the company’s ability to shore up liquidity through asset sales. The complexity of the situation proved too high for more traditional lenders, including banks.

Through close collaboration between our European Corporate Credit and Real Estate teams, we underwrote the company’s asset portfolio and quickly built a position based on its overall asset quality. It was our view that the asset value was materially higher even after applying severe impairment assumptions to the company’s development portfolio. This put us in a unique position to provide two new sources of financing.

First, we took a lead role in structuring negotiations to provide a new money instrument at the corporate level that was senior to the existing unsecured bonds, of which we funded a meaningful portion.

Second, due to our overall relationship with the company, we were invited to participate in a refinancing and up-sizing of a new direct real estate loan at the property company level. Due to delays in the implementation of the restructuring and an upcoming maturity deadline, the financing was required in very short order, limiting the pool of real estate lenders to those able to underwrite quickly and take down debt in size.

The new financings gave the company a much needed runway to facilitate asset sales and de-lever its balance sheet. We continue to work directly with the company with the goal of optimizing its capital structure and addressing substantial maturities that are coming due.

IN SUMMARY

Through our multiple decades of deep involvement in credit markets as both an opportunistic credit investor and a CLO manager we have had a front row seat shaping the evolution of the creditor playbook through various market cycles and times of extreme stress. Having navigated the complexities of intercreditor issues for decades, we are pleased to be on a shortlist of preferred capital providers that can act with creativity, speed, and scale when a company needs to address its capital structure.

Important Information

This material is provided to you for informational purposes only. This is neither an offer to sell nor a solicitation of any offer to buy any securities in any fund or account managed by Sculptor Capital Management, Inc. or Sculptor Capital LP and its affiliates (collectively, “Sculptor Capital Management,” the “Firm,” “Sculptor,” or the

“Company”), nor does it constitute a financial promotion, investment advice or an inducement or incitement to participate in any produce, offering or investment. Any offer to purchase or buy securities or other financial instruments will only be made pursuant to an offering document and a subscription document, which will be furnished to qualified investors on a confidential basis at their request for their consideration in connection with any such offering. Any investment decision should be based on the information contained in the private placement memorandum. This material does not create any advisory relationship; such a relationship may only be established through a formal advisory contract.

The statements made herein reflect the subjective views and opinions of Sculptor. Such statements cannot be independently verified and are subject to change. There can be no assurance that the investment discussed herein will ultimately be successful or are representative of all investments made in a particular Sculptor strategy or product. The information contained herein may not be reproduced or used in whole or in part for any purpose, and there can be no assurance any investment strategy will perform as discussed herein or that any historical trends will persist in the future. The source of all information contained herein is Sculptor, unless otherwise noted. Past strategy and investment allocations are not necessarily indicative of future strategy or investment allocations.

While private investment funds offer investors the potential for attractive returns and diversification, they pose greater risks than more traditional investments. Investors’ capital is at risk and investors may lose all or a substantial portion of their investment. Investors should consider the risks inherent with investing in private investment funds, which include, but are not limited to, leveraged and speculative investments, limited liquidity, higher fees and expenses and complex tax structures. The tax treatment of any investment will depend on the individual circumstances of each investor and may be subject to change in the future. Sculptor has in place policies and procedures designed to prevent market abuse and insider dealing. These policies and procedures are reviewed on a regular basis.

Certain information contained in this document constitutes “forward-looking statements” that can be identified by the use of forward-looking terminology such as

“may,” “will,” “should,” “expect,” “anticipate,” “target,” “project,” “estimate,” “intend,” “continue,” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of any Sculptor Capital investment may differ materially from those reflected or contemplated in such forward-looking statements.

Some of the information contained herein has been obtained from third party sources. Sculptor has relied on the accuracy of such information and has not independently verified its accuracy. Sculptor makes no representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein. Certain economic and market conditions contained herein have been obtained from published sources and/or prepared by third-parties and in certain cases has not been updated through the date hereof. All information contained herein is subject to revision and the information set forth herein does not purport to be complete. Past performance is not a reliable indicator of future results. A more detailed description of Sculptor’s investment strategy, objectives and related risk will be made available upon request. Past performance of any individual investment or Sculptor fund is not indicative of their future performance.

The information contained in this document is presented to inform decisions to use Sculptor Capital LP as an investment adviser.

1 - The investment example contained herein (the “Case Study”) is being provided for informational purposes only and is not intended to be and should not be considered a recommendation to purchase or sell any security or to invest in any fund managed by Sculptor. The Case Study was selected by Sculptor using non-performance based criteria as a representative example of the investment themes discussed herein. The Case Study is not presented (and was not selected) on the basis of performance. There can be no assurance that any Case Study or any actual account would realize its investment objectives or be profitable. Furthermore, there can be no assurance that any future investments will be realized at a profit, and any investment could lose all or a substantial portion of its value. The Case Study is not the only investment example that meets the aforementioned selection criteria.